In the fiercely competitive industry of consumer goods, two giants stand out: Procter & Gamble (P&G) and Unilever. As leaders in the industry, they command significant attention from investors, consumers, and market analysts alike. This post delves into a detailed comparison of these two titans, exploring their similarities, differences, and the unique strategies that have shaped their market presence. With P&G and Unilever’s revenue, brand strategy, and global footprint at the forefront, we’ll unravel the intricacies that define their dominance in the market. Join us as we dissect the financial prowess, investment strategies, and market perceptions that set these two behemoths apart, offering invaluable insights for investors, business enthusiasts, and market watchers.

Let’s dive into the showdown 🤼 between these titans and see what sets them apart.

Let’s start with what the have in common:

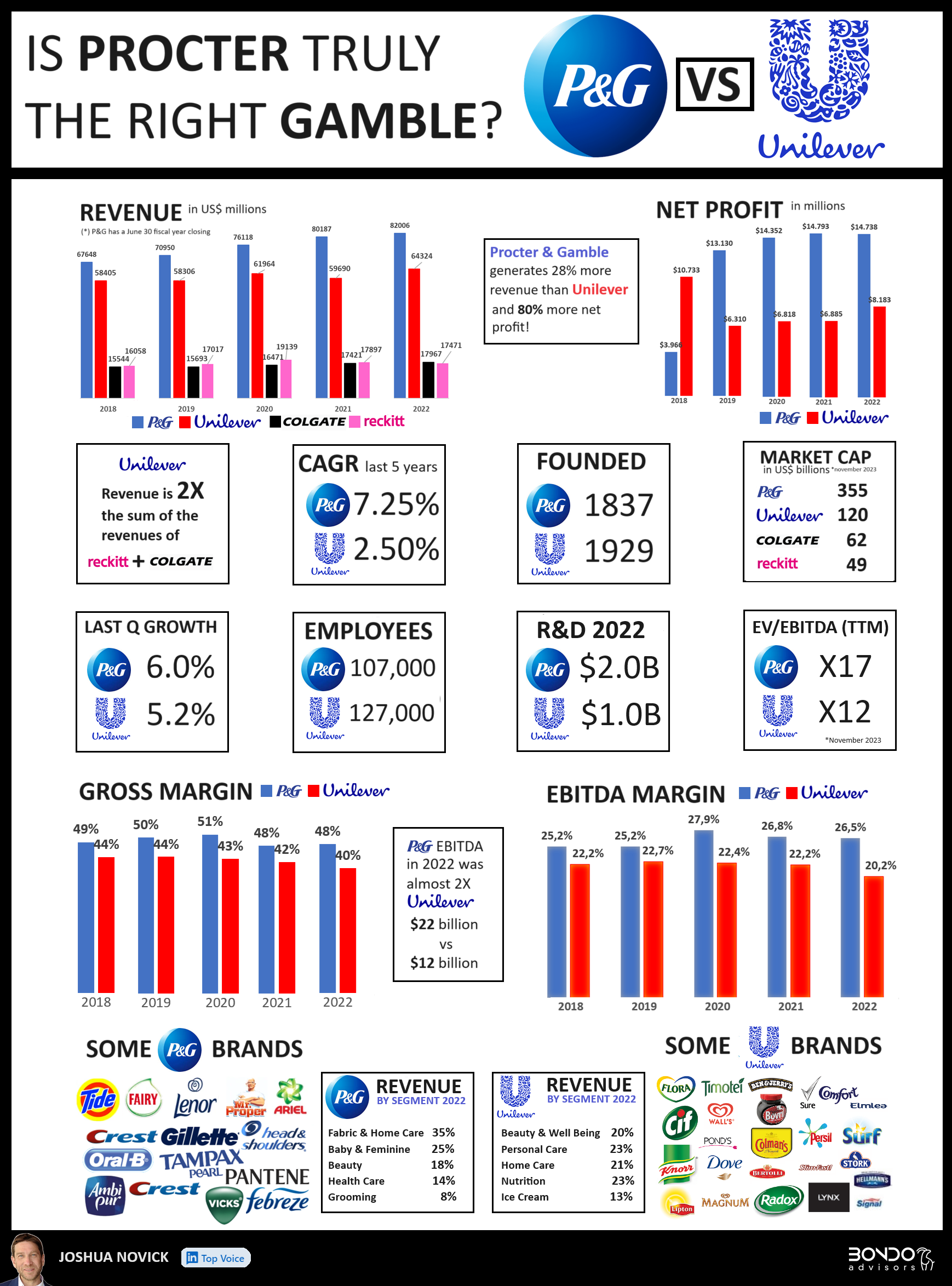

✅They are worldwide leaders in consumer goods. P&G’s revenue ($82B in 2022) is equal to the sum of Henkel ($22B revenue), Kimberly-Clark ($20B), Colgate-Palmolive ($18B), Reckitt ($17B) revenue.

✅They have a global footprint but with brands and products often adapted to the local tastes of consumers.

✅Both companies have grown through a combination of acquiring existing successful brands and developing their own new brands.

✅Both build brands through titanic investments in marketing. In 2022, Unilever spent $7.8B (13% of revenue) on Brand and Marketing, while P&G spent $8B (10% of revenue).

✅Both are huge free cash flow machines: Unilever ($5.2B in 2022) and P&G ($16.8B in 2022).

How are they different?

❎P&G is a pure player in home care and personal care. It was founded by two brothers-in-law, William Procter, a candle maker, and James Gamble, a soap maker when they formed a partnership back in the early 19th century.

P&G’s breakdown of sales:

🔸Fabric & Home Care: 35% of sales

🔸Oral Beauty and Personal Health Care: 32% of sales

🔸Baby, Feminine & Family Care: 25% of sales

🔸Grooming (Gillette): 8% of sales

❎Unilever, on the other hand, was the merger of two companies in 1929: Margarine Unie, a Dutch margarine producer, and Lever Brothers, a British soap maker.

It competes with P&G in

🔸 Personal Care (23% of sales),

🔸Home Care (21%), Beauty (20%),

🔸but also has a strong presence in the food segment (36% of sales) as an inheritance of its margarine maker origin.

❎Both companies invest substantially in R&D, but P&G invests ($2B in 2022), twice as much as Unilever ($1B).

❎Both companies are global, but P&G is still very US-dependent (44% of 2022 revenue). North America represents 50% of all sales, Europe 21%, China 9%, Asia & Pacific 8%, Latin America 7%, India + Middle East + Africa 5%.

❎Unilever’s revenue is more global: the US is only 20% of sales. Asia/Pacific/Africa represents 46% of sales, Americas 34%, and Europe 20%.

❎Unilever is still only about half the size of P&G (if you exclude their business in food/nutrition where they compete with giants like Nestlé, Danone, etc…)

❎P&G (almost $15B Net Profit in 2022) is substantially more profitable than Unilever ($8B Net Profit). Almost 2X

❎P&G has grown almost 3 times faster than Unilever in the past 5 years: respectively 7.25% CAGR and 2.5% CAGR.

❎P&G is the sweetheart of investors. Its market cap is 3X Unilever.

💵Unilever is currently trading at 12X EV/EBITDA (TTM) and 2.2X Sales (TTM)

💰P&G is trading at a super premium 17X EV/EBITDA (TTM) and 4.5X Sales (TTM)

Investors seem to believe P&G has a clear edge over Unilever going forward.

Is Procter really such a a good gamble❓

The comparison between P&G and Unilever reveals a fascinating narrative of corporate strategy, market positioning, and financial performance. While both companies share commonalities in their global influence and brand-building prowess, their distinct approaches to product diversification, R&D investment, and geographical focus highlight the uniqueness of their paths to success. P&G’s more concentrated business model and higher profitability juxtaposed with Unilever’s diversified portfolio and global spread illustrate varied paths to success in the consumer goods sector. As the market continues to evolve, the question remains: will P&G maintain its edge, or will Unilever’s diversified approach yield greater benefits in the long run? Only time will tell which strategy will prove to be the most effective in the ever-changing landscape of global consumer goods.