In the constantly changing and rapidly progressing world of online food and grocery delivery services, recent developments have raised critical questions about the sustainability and profitability of this sector. Major players like Getir, DoorDash, and Delivery Hero have faced significant challenges, with declining valuations and substantial losses marking a turbulent period. However, amidst these struggles, Instacart’s success story offers a glimmer of hope and valuable insights. This analysis delves into the current state of the online food delivery industry, examining the contrasting fortunes of these companies and exploring the key factors that could determine their future viability and success.

The fast-track grocery delivery service Getir just announced it had to slash its valuation to less than 1/4th, from its peak valuation 18 months ago,(from $12B to $2.5B) in order to raise the additional $500M it needs to stay alive.

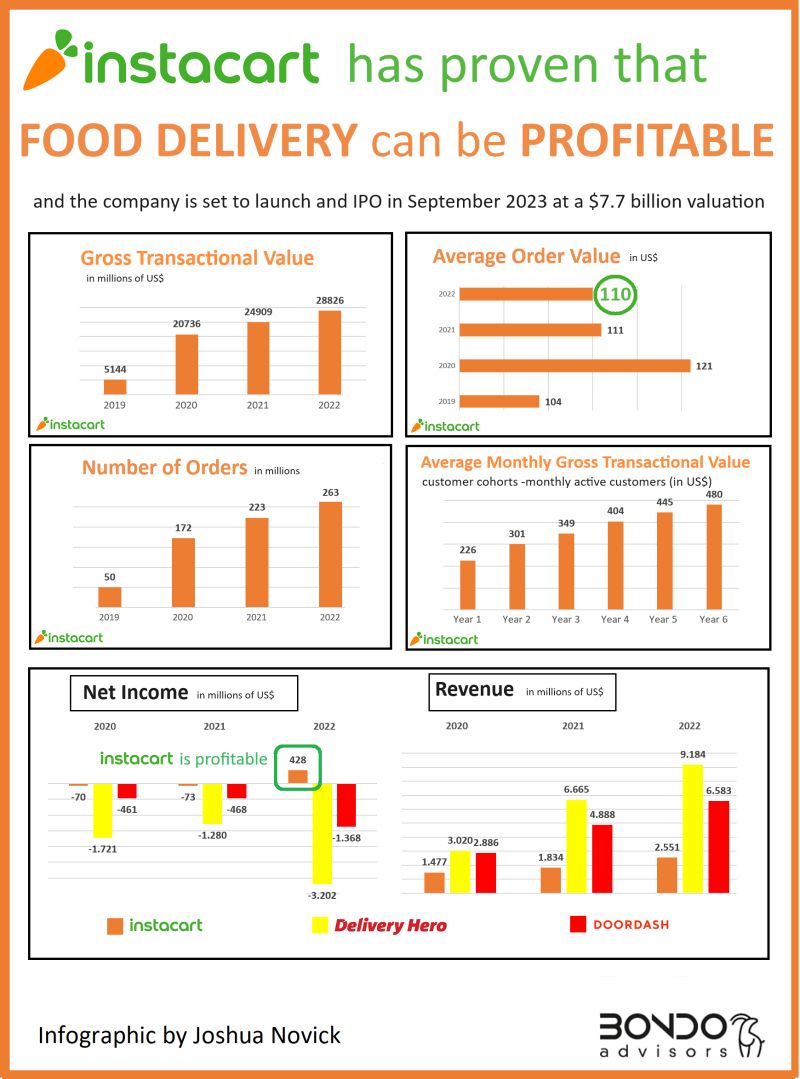

US food delivery leader, DoorDash lost a record $1.4 billion in 2022, and German category champion Delivery Hero lost $3.2 billion in the same year.

Both companies have been struggling to find a path to profitability, and despite all their effort in the 1st half of 2023 DoorDash reported a loss of $331M and Delivery Hero reported losing €820 million euros

Is there hope for the online food delivery services❓

Yes, maybe 😉

Especially if you look at what Instacart has achieved: $420 million net profit in 2022!

Ok, Instacart is not exactly in the same space as the rest.

Instacart delivers grocery to consumers from partner grocery stores, same day, but not super speedy (which makes logistics a lot simpler)

Getir delivers grocery from their own dark stores in 30-minutes

DoorDash and Delivery Hero also deliver grocery, but their main business is delivering to-go meals from restaurants to consumers.

What are some of the keys to Instacart’s profitability❓

🔑The average order of Instacart is $110. That is over 3 times the average order value of DoorDash, which was around $32 per order in 2022.

If you look at the unit economics of a Instacart typical $110 order, it looks like this:

Fees:

💲7 —Instacart charges the retailer an average of 6.3% fee

💲0,40— Instacart charges the consumer an average of 8.6% delivery fee. The delivery fee goes almost completely to the “shopper” (the «rider») which makes an average of 8.2% of the order value.

Advertising

💲3 —Instacart also generates about 2.6% order value in advertising

Total Revenue per order:

💲10.5—- Revenue (after delivery cost) = 9.5% of Average Order

❌On the other hand my bet is that Getir will never be profitable. There just is not enough demand for 30-minute grocery delivery. I mean, there is not just enough demand for super fast delivery at the price a consumer would need to pay. Getir and Gorillas grew only because they were “dumping” a service at a huge unit-economics loss.

✅On the other hand, the service Delivery Hero, DoorDash Glovo, Deliveroo (etc) provide is something that enough consumers want /need. There are enough consumers willing to pay for this service at a “fair price.”

The clue to success is Instacart’s revenue.

Instacart’s revenue is less than 1/3 of Delivery Hero’s revenue, but it is nicely profitable.

Why is revenue a clue❓

🗝️Very simple. In order to be profitable, food delivery services will need to cater their services only to those consumers who are willing to, either pay much higher delivery fees, or make much larger orders. Unfortunately, that is only a portion (30% or 50%?) of their current customer base, but my bet is that it still is a huge total addressable market and opportunity.

The contrasting fortunes of companies like Getir, DoorDash, Delivery Hero, and Instacart in the online food delivery sector highlight a pivotal moment for this industry. While the struggles of some companies underscore the challenges of achieving profitability in a competitive market, Instacart’s profitable model provides crucial lessons. The key to sustainability lies in targeting consumers willing to pay higher delivery fees or place larger orders, a strategy that may shrink the customer base but still taps into a significant market opportunity. As the industry continues to evolve, these insights could be pivotal in shaping the future of online food delivery services, balancing consumer demand with the imperative of financial viability.