In the world of sports apparel and footwear, few names resonate as profoundly as Nike. This iconic brand has established itself as the second-largest apparel company globally, trailing only behind the luxury giant LVMH and surpassing renowned names like ZARA.

Nike’s journey from a humble distributor of Japanese running shoes to a behemoth in the apparel industry is a testament to its innovative strategies and relentless pursuit of excellence. In this in-depth analysis, we delve into Nike’s market position, financial performance, marketing strategies, and the unique history that shapes its current stature. From dominating sales figures to strategic endorsements and the story behind its sibling rivalry with Adidas and Puma, we uncover the facets that make Nike a leader in the global apparel market.

👟Nike is the second largest apparel business worldwide, just behind💎 LVMH (which is in the luxury category), and proceeding 👗ZARA SA

🧮Some numbers:

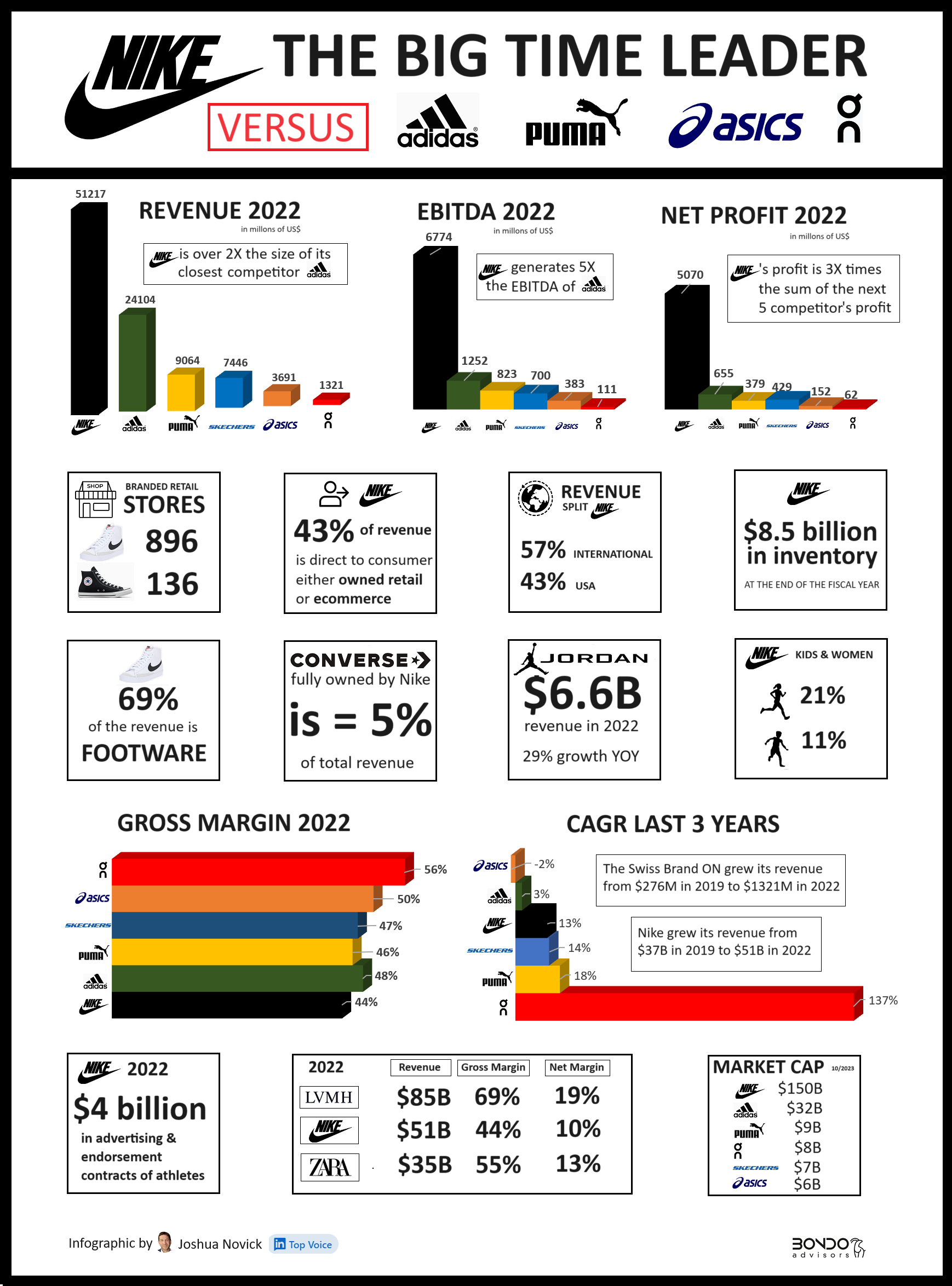

🔹Nike is by far the leader in the footwear and sports’ apparel segment. Nike’s sales are 2X adidas, almost 6X PUMA Group and 7X Skechers, and 14X ASICS Corporation.

🔹Interestingly it has the lowest gross margin of all its direct competitors (44%), trailing almost 12 percentage points from On in gross margin. It is also far behind LVMH (that has a mind blowing 69% GM) and even substantially below the fashion brand Zara (55% GM).

🔹Nevertheless, Nike is very profitable with a 13% EBITDA margin and 10% net profit margin. Substantially above Adidas (5% EBITDA margin and 3% Net Profit), Puma (9% and 4%), or Skechers (9% and 6%)

🔹Nike is growing at impressive rates: 13% CAGR in the past 3 years. Adidas only grew 3% CAGR in the same period and Asics -2% CAGR.

🎯Marketing:

🔹In 2022 Nike spent 💲4 billion on advertising and endorsement contracts of athletes (Adidas spends 💲2.7B) Nike’s marketing budget is greater than Asics total billings for 2022.

🔹Nike relies heavily on endorsement contracts with top athletes in basketball, tennis, and athletics, the three sports that use shoes that can be also be worn casually by consumers off the field.

🔹Through the 90’s Nike’s revenue was generated almost entirely via wholesalers and retail partners. The first Nike Store was opened in 1990. Since then, Nike has been ramping up its direct-to-consumer business that currently generates 43% of total revenue.

⛹🏿Air Jordan

🔹The Jordan brand ($6.6B in revenue in 2022 and 29% growth YOY) is now almost 3X the size of Converse ($2.4B revenue in 2022 and 3% growth YOY). Converse was bought by Nike for only $300M in 2003.

🔹Michael Jordan allegedly has a 5% royalty fee on all Jordan’s sales: that’s 💲330M in royalties just in 2022. WOW 🤯

💰Money:

🔹Nike was sitting on about $11B cash at the end of the last Q.

🔹Phil Knight, the founder, who retired as CEO in 2016, is still the largest shareholder of Nike, and is the 28th richest man in the world (Forbes) with a net worth of about 💲40B

👻Trivia:

🔹Adidas and Puma are actually “brother companies.” Adidas origin was founded in the 1920’s by Adi Dassler and Puma was founded 1948 by his brother Rudi Dassler (who left to start a competitor, Adi was not happy).

🔹Blue Ribbon Sports (the original name of Nike when it was founded in 1964) started as a distributer for the west coast for the Japanese running shoe brand Onitsuka Tiger (which today is ASICS Corporation). Blue Ribbon Sports started producing Nike branded shoes in 1971.

🔹Knight ran 🏃track at the University of Oregon and created Nike shoes with his former track coach, Bill Bowerman, who was obsessed with the competative edge shoes could provide to athletes.

🔹Puma’s largest single shareholder is Artemis, François Pinault’s luxury group which also owns Gucci, YSL, BALENCIAGA, etc.

Nike’s remarkable journey in the apparel and footwear industry exemplifies a blend of strategic marketing, relentless innovation, and a deep understanding of consumer needs. Despite facing stiff competition and market challenges, Nike has not only sustained its leadership position but has also exhibited impressive growth and profitability. The brand’s ability to adapt to changing market dynamics, coupled with its effective use of endorsements and direct-to-consumer strategies, continues to set it apart from its competitors. As we look to the future, Nike’s ongoing commitment to innovation and brand strength positions it well to remain a dominant player in the global apparel industry. The story of Nike is more than just a tale of business success; it’s a narrative of vision, resilience, and the relentless pursuit of excellence.