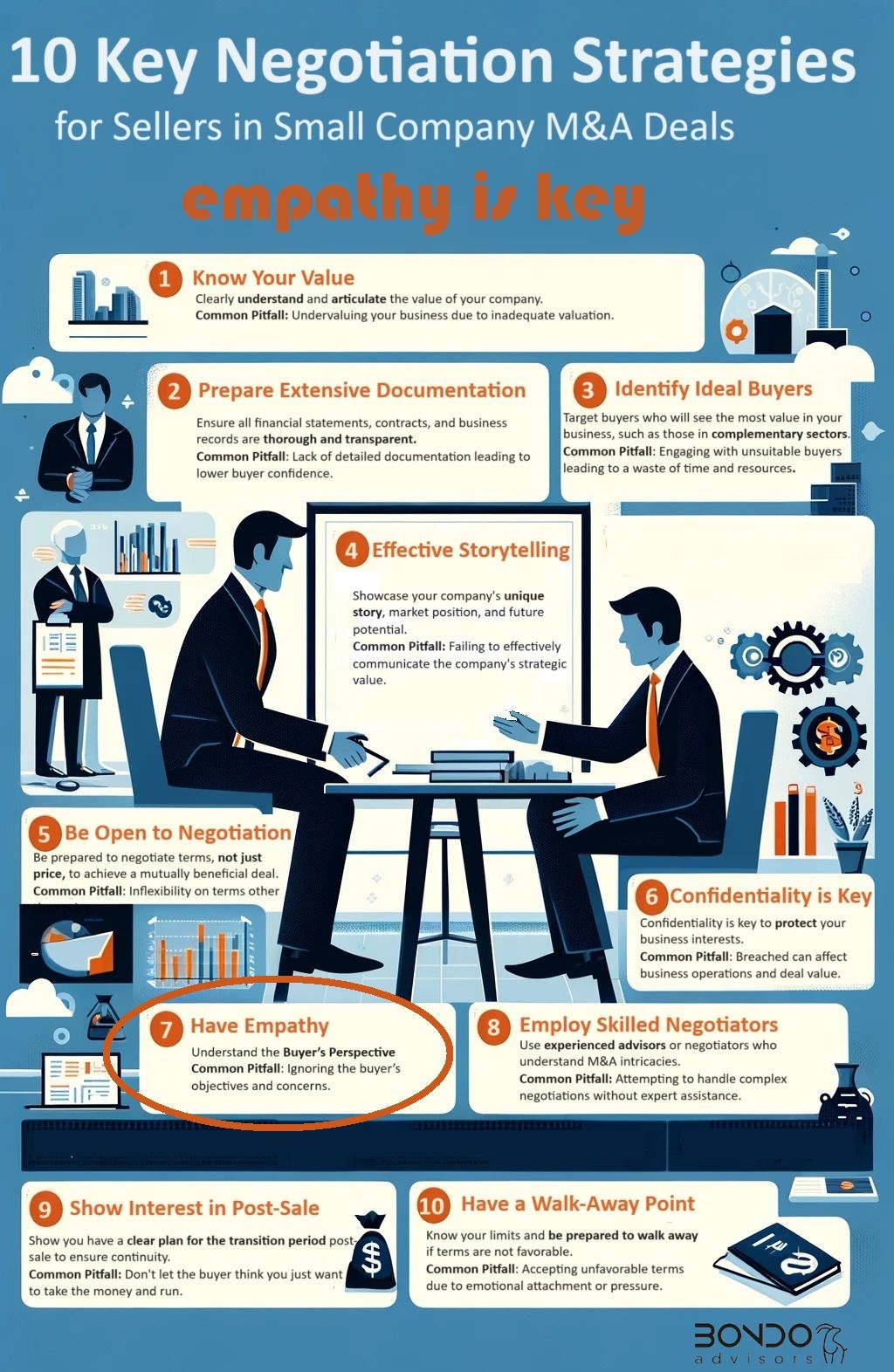

Empathy. Not just any empathy, but a strategic and informed empathy that underpins effective negotiations in M&A transactions.

I’m not talking about the kind of Christian empathy rooted in compassion, selflessness, and benevolence. While these are noble traits, a overly Christian approach will probably result in a bad deal.

Instead, I refer to the concept of empathy as defined by Alfred Adler: «seeing with the eyes of another 👀, listening with the ears of another 👂, and feeling with the heart of another ♥️.»

👥This approach is crucial in sell-side M&A. It’s not just about marketing your company; it’s about engaging in a dialogue. Ask probing questions to different C-level executives and stakeholders on the buyer’s side to gain a comprehensive understanding.

Why are they interested in acquiring a company❓

What specific attributes make your company a compelling target❓

What standalone risks and opportunities do they foresee❓

Post-transaction, what could potentially go wrong❓

What are the inherent risks of the deal itself❓

✅Effective negotiation goes beyond hashing out terms and clauses. It’s about addressing the fundamental risks and aligning the transaction with the goals of all parties involved.

✅When you understand the buyers fears and goals you can work on solutions that can protect both parties.

🔸For example, consider the negotiation of an earn-out clause. As a seller, your initial goal might be to secure as much of the payment upfront at closing, while the buyer prefers a variable payment. To effectively negotiate, it’s crucial to understand the buyer’s rationale. Why are they insisting on a variable payment, and why is it based on a specific P&L item, such as EBITDA?

🔸By asking targeted questions and actively listening, you might discover that the buyer’s concerns stem from doubts about the feasibility of projected synergies, or worries that key management might depart absent a significant variable compensation component.

🔸So, how can you, as a seller, address these concerns without bearing the risks associated with an EBITDA-based earn-out, which encompasses uncertainties in revenue, cost factors, and potential disputes over EBITDA calculations❓ One strategy could be to propose an earn-out based solely on achieving specific cost-saving targets, which are generally more predictable than revenue synergies. Additionally, offer bonuses contingent upon management’s continued engagement and positive performance within the company.

🔸When presenting this counterproposal, frame it empathetically: «I understand your concerns about [XYZ]. To address these, I’ve considered an alternative approach that might alleviate these issues…'»

💊By aligning your proposal with the buyer’s fears and objectives, you create a win-win scenario, making the deal more appealing and grounded in mutual understanding.

The essence of successful sell-side M&A lies in the ability to transcend basic negotiation tactics and embrace a strategic empathy that resonates with buyers’ concerns and objectives. By asking targeted questions, actively listening, and aligning proposals with the buyer’s perspectives, sellers can forge win-win scenarios that go beyond mere transactional gains. This approach not only mitigates risks but also fosters a deeper understanding and alignment of goals, thereby enhancing the overall efficacy and success rate of the company sales process. In the ever-evolving landscape of M&A, empathy, when strategically applied, is not just beneficial—it’s essential.