🐭The The Walt Disney Company is known by many for its original iconic creations: Mickey Mouse, Donald Duck, and Winnie the Pooh…

♠️However, it is also widely recognized for its compulsive approach to mergers and acquisitions.

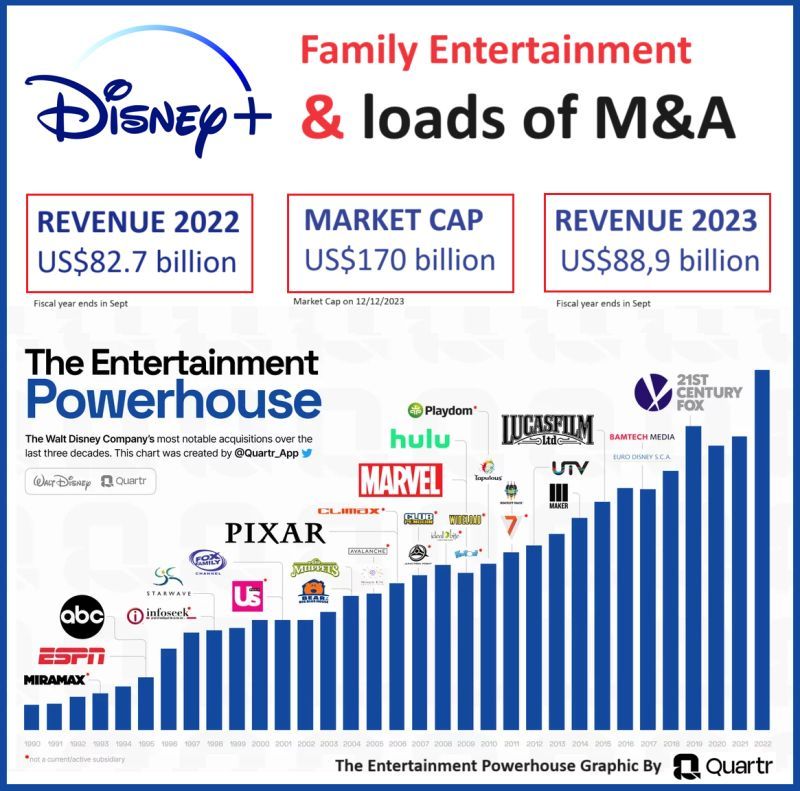

👉Disney was founded in 1923 but it only executed its first major acquisition 70 years after, in 1993 with the Miramax $60 million deal.

👉In the following 30 years Disney has become one of the most aggressive aggregators of the entertainment market. Spending over $130 billion on 12 major acquisitions (besides a bunch of lesser value deals)

Here goes the list:

🔸1995: ABC and ESPN join the Disney family for $19 billion.

🔸2001: Acquisition of Fox Family for $2.9 billion.

🔸2004: The Muppets Studio becomes part of Disney for $75 million.

🔸2006: Pixar Animation Studios, known for hits like ‘Nemo’ and ‘Toy Story’, is acquired for $7.4 billion.

🔸2009: Was a pivotal year with Disney acquiring Marvel Entertainment for $4 billion, bringing superheroes like Avengers, Spiderman, and Black Panther under its wing. The same year, Disney also began its investment in Hulu, culminating in 2023 with the acquisition of the final 33% from Comcast for $8.6 billion.

🔸2010: Playdom, a game developer, was bought for $560 million.

🔸2012: Disney acquired Lucasfilm for $4 billion, adding Star Wars to its portfolio.

🔸2014: Maker Studios was acquired for $500 million.

🔸2017: Bamtech joined Disney for $2.6 billion.

🔸2019: Disney executes the highest value deal buying 21st Century Fox for $71 billion (cash+stock)

😱The total price tag of Disney’s 30 year M&A activity is equivalent to 75% of Disney’s current market cap.

🥖Some food for thought

🌳In 1993 Disney was generating 8.5B revenue and had a 17 billion market cap

⏳In the past 30 years Disney has increased its market cap about $150 billion, but has spent 💲130 billion in M&A deals to create basically $20 billion in additional value.

🛎️The Compound Annual Growth Rate (CAGR) of revenue, during Disney’s 30 year M&A spur, was approximately 8%.

💊My thoughts:

Disney is currently competing with aggressive and cash rich newcomers in the entertainment industry, like Netflix, Amazon, and Apple, in a space where content is king. Disney’s strategy has been to go out and acquire the content leaders.

The extent to which Disney’s aggressive mergers and acquisitions strategy was purely defensive remains unclear. However, what is clear is that, at least in the short term, they have not generated the level of value one might have anticipated.

No doubt that the Marvel, LucasFilms and Pixar acquisitions were super deals. The +💲70B investment to buy 21st Century Fox is, by all means, at least questionable.

👓I adapted Quartr‘s wonderful graphic «The Entertainment Powerhouse» to include some additional data . Many thanks to Quartr (a super useful financial research APP) for the insightful Infographic