In the dynamic world of retail, three giants stand out with their distinctive business models and strategies: Amazon, Walmart, and Costco Wholesale. Each of these retail leaders has crafted a unique value proposition that caters to different segments of the market.

🚀Amazon, Walmart, and Costco Wholesale: 3 🛒leaders with 3 unique value propositions:

👜Walmart emphasizes accessibility, price and colossal selection.

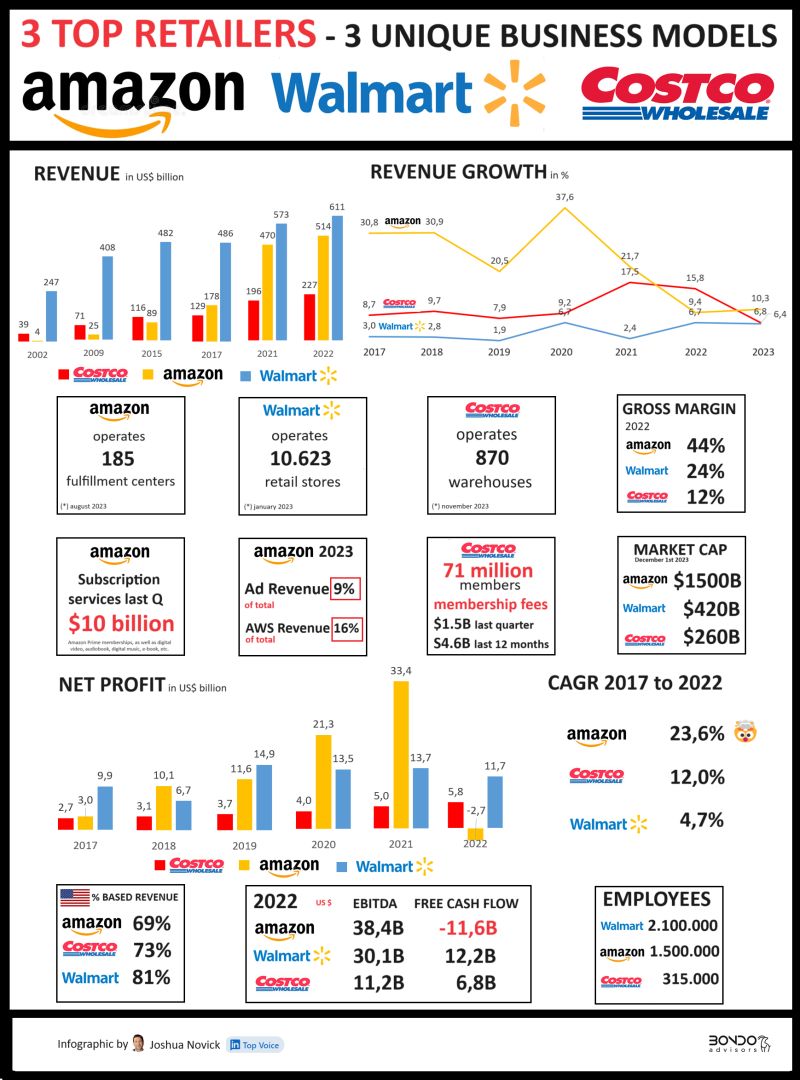

🔸Among the three contenders, Walmart is undoubtedly the more traditional retail player and remains the world’s largest retailer (and 🥇company).

🔸Notably, nearly all of Walmart’s revenue comes from retail operations, while only approximately 2/3 of Amazon’s revenue is currently retail.

🔸While Amazon is expected to catch up to Walmart, this may happen a bit later than anticipated. Recent years have seen Amazon’s growth rate slow down (only a few % points above Walmart’s)

🔸Walmart primarily operates as a brick-and-mortar retailer, with a modest 13% of its revenue originating from ecommerce

🏭Costco stands out with exclusive memberships and bulk purchase savings

🔹Costco, in contrast, adopts a unique approach. It operates as a membership-based store with a warehouse style layout characterized by high ceilings, industrial shelving, pallets of products, and a broad assortment of items available in bulk.

🔹Costco typically stocks around 4,000 different products at any given time, a stark contrast to Walmart’s extensive inventory of 140,000 SKUs. Both Amazon and Walmart list approximately 500 million SKUs online.

🔹Costco focuses on bulk purchases and pledges to offer the lowest prices possible, maintaining an average margin of 11% and ensuring no product exceeds a 14% gross margin.

🔹Approximately one-sixth of Costco’s gross margin is derived from the $60 annual fees paid by its 71 million members for the privilege of

shopping at Costco. Notably, about half of Costco’s pre-tax profit is generated from membership fees

🔹Costco excels in operational efficiency, maintaining low operating expenses at just 9% of billings, compared to Walmart’s 20%.

🔹Costco achieves a remarkable per-store revenues of $280 million, far surpassing Walmart’s $60 million per store.

🚚Amazon offers convenience and a vast product selection.

💠Amazon has experienced remarkable growth, expanding from only $4 billion in revenue two decades ago to a staggering $500 billion in 2023.

💠The company is renowned for its super fast product deliveries. However, this efficiency comes at a significant cost, with fulfillment expenses accounting for over 15% of total billings, and operating expenses comprising 41% of total billings.

💠These high operating expenses have made it challenging for Amazon to generate a profit in its e-commerce/retail business.

💠Nevertheless, Amazon has diversified its revenue streams effectively. Its subscription business, including Prime, generated over $30 billion in revenue in the first 9 months of 2023, while ads brought in an additional $30 billion in the same period.

💠Additionally, (Amazon Web Services (AWS) generated nearly $59 billion in revenue and an impressive $18 billion in operating margin in the first three Qs of 2023.

The retail landscape is characterized by the diverse approaches of Amazon, Walmart, and Costco, each playing to its strengths and catering to specific consumer needs. Walmart continues to dominate as a traditional retail player, leveraging its massive selection and competitive pricing. Costco differentiates itself with a membership-based model, focusing on bulk purchases and operational efficiency. Amazon, meanwhile, is a powerhouse in e-commerce, driven by its vast product selection and rapid delivery services.

These companies’ varied strategies underscore the complexity and competitiveness of the retail sector, where each player adapts to market demands while innovating to stay ahead. As they evolve, these retail giants not only shape consumer experiences but also set the pace for the industry’s future.