In the fast-paced realm of technology, there are giants whose names echo in every corner of the industry. Yet, there exists a titan that operates with such finesse and strategy that it might have slipped under your radar – Constellation Software Inc. This tech behemoth, often unrecognized in the mainstream media, has been quietly revolutionizing the software world with its unique business model and impressive growth trajectory. Let’s delve into the intriguing journey of Constellation Software, a company that has mastered the art of growth while maintaining a surprisingly low profile.

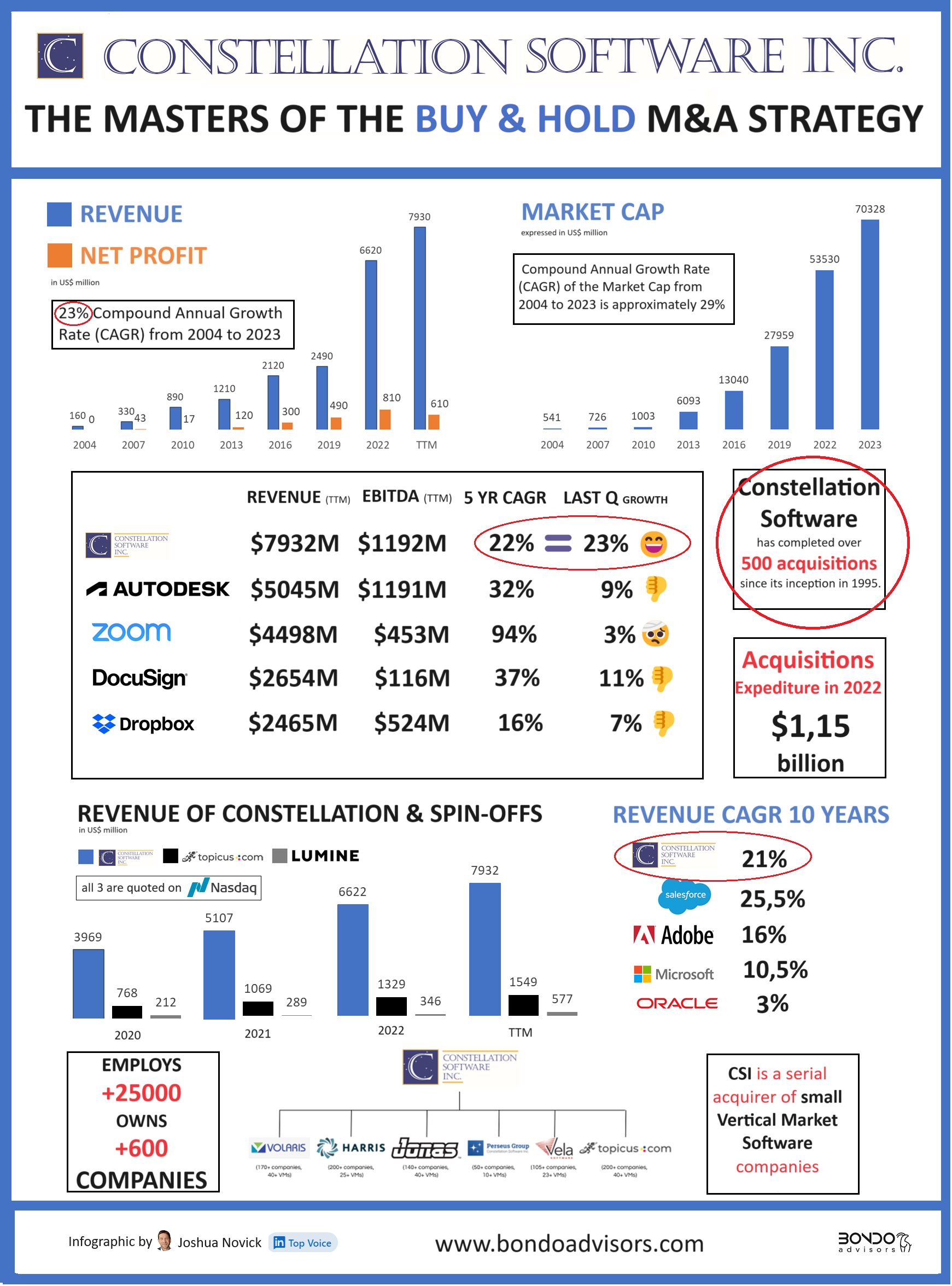

🛒 Constellation is a Voracious Acquirer: In < 30 years it has acquired +500 software companies.

🤫 Under the Radar: Despite its low public profile, it markets around 600 different software solutions across numerous industries.

🕵️♂️ Unlike a PE Firm: In contrast with Private Equity, Constellation Software holds companies «forever,» focusing on long-term growth.

💡 Unique Acquisition Strategy:

▪️Targets small software companies (even as low as $1M in revenue) and only occasionally larger ones (even a few hunded million in revenue)

▪️Funds acquisitions through business cash flow, sometimes using debt.

▪️Prefers bootstrapped over VC-funded companies.

📈 Super Growth:

Last 12 months’ revenue: ~💲8 billion and 💲1.2 billion EBITDA. To put that into context the revenue is 3X DocuSign or Dropbox’s!

📊 2022 growth: 30% (Organic growth: -1%).

▪️Consistent growth. The company has been growing steadily for the past 20 years at a 23% CAGR.

▪️Last 10 years, 21% CAGR, Last 5 years 22% and last Q 23%. Hard to be more predictable!

💹 Revenue Breakdown:

▪️Maintenance/recurring fees: 70%

▪️Software license fees: 5%

▪️Professional services: 21%

▪️Hardware sales: 4%

👥 Staff & Marketing:

Staff costs: 71% of expenses, 54% of revenue.

Sales and Marketing: Only 7% of revenue.

📣 Advertising: 💲86M in 2022 (1.3% of revenue). So no going crazy buying Google Ads to generate leads and sales…

They just buy companies to grow 🙃

🌎 Geographic Reach:

USA & Canada: 60% of revenue.

Europe: Nearly 30%.

The success of the model (Constellation trades at 7✖️ 12 months trailing revenue and 45✖️ times EBITDA, and I can assure you they buy at a considerably lower multiples…) has incited many other software companies to imitate the same strategy.

Asure Software, Asseco, Ascential, CHAPTERS Group AG, Descartes Systems Group, Software Circle plc, Lifco, Lumine Group & Topicus (2 spin-offs of Constellation) , OpenText, Tiny, Tyler Technologies, Upland Software, Vitec Software Group

But also a bunch of private (and often PE backed ) rollups like: Abingdon Software Group, Banyan Software, Dry Line Partners, Everfield, Magnolia Software, saas.group, SaaS Acquire Inc., Threecolts, Upland Software, etc…

Constellation isn’t just another player in the tech industry; it’s a visionary giant with a strategy as unique as its portfolio. Constellation’s approach of focusing on long-term growth, acquiring small and niche software companies, and maintaining a low-key marketing strategy has set it apart in a sea of aggressive tech players. With a consistent growth pattern and a geographical reach that spans continents, Constellation stands as a testament to the fact that success in tech doesn’t always have to follow the conventional path of flashy marketing and rapid scale-ups. As we look towards the future, Constellation Software Inc. is not just a company to watch but a remarkable case study in strategic growth and sustainability in the ever-evolving world of technology.